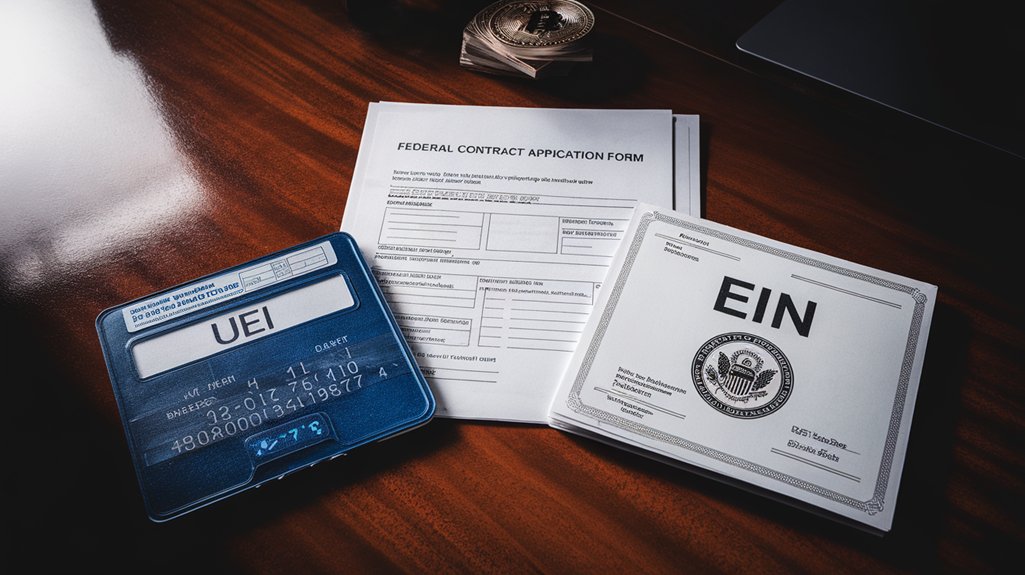

The UEI (Unique Entity Identifier) and EIN (Employer Identification Number) serve different purposes in federal contracting. The UEI, obtained through SAM.gov, identifies businesses for government contracts and grants, replacing the former DUNS number. The EIN, issued by the IRS, functions as a tax identification number for employment reporting. Both identifiers are mandatory for federal contracting, with UEI focusing on contract eligibility while EIN handles tax administration. The following sections detail each registration process and compliance requirements.

Understanding UEI Vs EIN: Key Differences and Purposes

While both serve as identification numbers for businesses, the Unique Entity Identifier (UEI) and Employer Identification Number (EIN) fulfill distinctly different roles in the federal ecosystem.

These entity identifiers operate in separate domains with minimal overlap.

The UEI functions specifically for government contracting purposes, issued through SAM.gov to identify entities doing business with federal agencies. It streamlines award management and enables access to federal contracting opportunities at no cost to businesses. The UEI represents a significant improvement over the previous DUNS Number system by enhancing security and improving overall data management. All entities seeking to receive federal financial assistance must obtain a UEI through the official SAM.gov website.

In contrast, the EIN serves primarily as a tax identification number issued by the IRS. This purpose distinction is critical—an EIN focuses on tax administration and employment reporting, while a UEI facilitates federal contract and grant management.

Both identifiers are free to obtain and required for their respective functions: UEIs for federal awards and grants, and EINs for tax compliance and business operations.

The Registration Process: How to Obtain UEI and EIN

Securing the appropriate identification numbers represents a critical step for businesses seeking to operate legally and participate in federal contracting opportunities. The registration steps for each identifier follow distinct pathways through different government agencies.

To obtain a UEI, entities must complete their registration through SAM.gov, which requires creating a Login.gov account and providing thorough business information including legal name, address, and incorporation date. This process involves validation against government databases and may take several days to complete. The SAM.gov platform provides a troubleshooting guide for common issues that may arise during the UEI application process.

Securing a UEI through SAM.gov demands comprehensive business documentation and patience during the validation process.

In contrast, EIN application methods offer greater flexibility. Businesses can receive an EIN immediately through the IRS website by submitting Form SS-4 with the responsible party’s information. Alternatively, applicants can submit this form via fax for those preferring non-online options.

Both registration processes are free services provided by the U.S. government, though UEI registration typically demands more detailed documentation and verification steps than EIN applications.

Federal Contract Requirements: When You Need Each Identifier

Federal contractors face complex identification requirements that vary depending on contract types, funding sources, and business activities. The UEI serves as the mandatory primary identifier for all federal contracts, replacing the former DUNS number system in April 2022.

Any entity seeking to bid on federal contracts must obtain a UEI through SAM.gov before submitting proposals.

The EIN, while not exclusive to federal contracting, remains essential for tax administration related to contract payments. Federal agencies require both identifiers at different stages of the procurement process:

- Pre-award phase: UEI required for initial registration and bidding

- Contract execution: Both UEI and EIN needed for award documentation

- Payment processing: EIN necessary for tax withholding and reporting

For grants and cooperative agreements, 2 CFR Part 25 specifically mandates UEI registration, while tax regulations simultaneously require EIN compliance.

Entities without both identifier requirements properly registered risk disqualification from federal opportunities. The transition to UEI eliminated the need to request identifiers through third parties as existing DUNS holders were automatically assigned UEI numbers during the system migration. Unlike EINs which can change under certain circumstances, UEI numbers remain constant throughout a business’s entire operational lifespan.

The application process for obtaining a UEI includes creating a SAM.gov account, verifying your entity information, and submitting the required documentation.

Frequently Asked Questions

Can Foreign Entities Obtain a UEI Without a U.S. EIN?

Yes, foreign entities can obtain a UEI without a U.S. EIN.

During the UEI application process, foreign entity registration requires only their home country’s legal business name and tax identification number.

Foreign organizations must still complete SAM.gov registration and obtain an NCAGE code prior to UEI issuance.

The UEI serves as the federal award identifier, operating independently from tax compliance requirements.

SAM.gov specifically accommodates international registrants who have no U.S. tax nexus.

How Often Must UEI and EIN Information Be Renewed or Updated?

The UEI (Unique Entity ID) does not require regular renewal and remains valid indefinitely unless organizational changes occur.

Similarly, EINs (Employer Identification Numbers) do not have a renewal schedule but must be updated when business structure changes notably.

While these identifiers themselves don’t expire, they must be verified during the annual SAM registration renewal process that occurs every 365 days.

Organizations should review UEI and EIN information periodically to confirm accuracy.

Can One Entity Have Multiple UEIS or EINS?

Regarding multiple registrations and unique identifiers, a single entity cannot have multiple UEIs under one SAM registration.

However, separate business divisions may obtain different UEIs if they register independently.

For EINs, an organization can have multiple numbers for distinct business entities within its structure.

For example, a parent company might have one EIN while its subsidiaries each maintain their own for tax purposes.

What Happens to My UEI if My Business Structure Changes?

When a company undergoes business structure changes, the UEI impact varies based on the significance of the change.

Minor modifications typically allow entities to retain their existing UEI, while major restructuring might require a new identifier.

In all cases, entities must update their SAM.gov registration to reflect these changes and provide appropriate documentation.

Companies should notify SAM.gov promptly after structural changes to maintain compliance and guarantee uninterrupted eligibility for federal contracting opportunities.

Are UEI Numbers Publicly Searchable Like Some EIN Information?

UEI numbers have limited public information accessibility compared to some EIN data.

While basic entity information in SAM.gov does contain searchability features through the public search portal, detailed UEI data typically requires proper authorization.

Unlike certain EIN information that appears in various public databases, UEI numbers maintain a higher level of privacy protection.

Users can search for organization names in SAM.gov, but accessing complete UEI records often necessitates registration or specific permissions.